New Paradigm Calls for More Dynamic Portfolio Management

Extraordinary monetary accommodation (Quantitative Easing [QE] or expansion of the Fed Balance Sheet) provided equities with over a decade-long runway for above average returns while bond yields steadily declined to reach historic lows. This period of low inflation (the QE Era) from 2009-2021 provided a great return environment for U.S. stocks and long-term bonds (chart below).

These dynamics changed dramatically in 2022. Global stocks declined 19% as inflationary pressures ushered in a new paradigm of Quantitative Tightening (reduction of the Fed Balance sheet) and constrained liquidity (chart below). In our view, this new monetary regime requires a more dynamic approach to managing portfolios as opposed to the static strategy of owning the S&P 500 and long-term bonds that was so successful during the QE period.

In 2022, both the S&P 500 and U.S. investment grade corporate bonds declined by 18% as persistent inflation caused a spike in bond yields and decline in equity valuations. Importantly, following the valuation reset for stocks and bonds, long-term return potential has improved considerably.

A dynamic and disciplined approach to managing long-term portfolios will be critical to success, in contrast to the (set-it and forget-it) approach that worked during the QE era (2009-2021)

What now?

We are long-term investors with an investment process that marries fundamental, macro and technical analysis. In the near-term, elevated market volatility is likely to continue due to ongoing inflation and constrained liquidity, which has recently been exacerbated by the banking crisis. Despite these challenges, we believe dynamically managed balanced portfolios offer attractive return potential over the next five years, particularly relative to the 2.3% expected annual inflation over the same period.

Why Dynamic Management?

Unprecedented monetary policy during the QE period (2009-2021) provided a historic tailwind to stock and bond returns. Global central banks were able to suppress interest rates in an environment of low inflation for over a decade. Everything changed in 2022 as the bill came due for the policy largesse in the form of high inflation and concomitant rate hikes. This shift in monetary policy and inflation undermined the static allocation to U.S. (growth) stocks and long-term bonds that was so successful during the QE era.

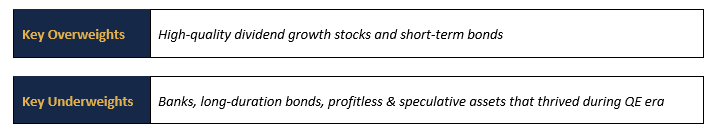

Notably, in contrast to consensus positioning in long-term bonds at the beginning of 2022, we instead favored high quality, short-duration bonds, which fared considerably better than long-term bonds. Bond prices move inversely to interest rates, and we had conviction that the market was underestimating the magnitude of rate hikes needed to contain inflation. The widely followed Bloomberg U.S. Aggregate Bond Index declined by 13% during 2022, the worst year on record (dating back to 1976).

In addition to avoiding big losses in long-term bonds over the past year, we have been taking advantage of the evolving interest rate environment by purchasing short-term U.S. Treasuries and high-quality municipal bonds offering total returns of 4-6%. Furthermore, our dynamic and disciplined approach to managing portfolios has led us to make other key calls during the 2022-2023 post-QE market period (below table).

We significantly reduced our exposure to banks over the past 12 months with the view that Fed rate hikes would be a headwind to bank earnings via lower net interest margins.. In addition, we sold First Republic Bank across all portfolios on March 8th at $98 per share, prior to the subsequent 93% decline in the stock to $6. Our experience and disciplined process led us to conclude the stock should be sold given the similarities to Silicon Valley Bank and potential downside risk to the stock. Both banks were prime beneficiaries of the QE era with business models that have been abruptly undermined by the paradigm shift in monetary policy. Avoiding long-duration bonds in 2022 and selling First Republic Bank in March 2023 - prior to the 93% decline in the stock - highlight the critical importance of dynamic portfolio management in the post-QE era.

The chart to the right is based on an analysis by J.P. Morgan Asset Management shows that the “Average Investor” has returned 8.7% per annum for the past 10 years ended 12/31/21 versus 11.1% for a static 60/40 portfolio. The 2.4% annualized underperformance by the average investor, compared with a similar static portfolio, resulted from poor market timing - buying high and selling low. Our disciplined process seeks to avoid the perils of market timing and maximize returns over the long-term.

We believe we are in an era where a thoughtful, independent research-driven process can add value through dynamic equity/fixed income portfolio management, global tactical allocation insights, as well as sector and stock selection. Our equity strategies own companies with pricing power, strong cash flows, and management teams committed to shareholder return. In the U.S., we are finding opportunities in the health care, energy, consumer, cybersecurity, artificial intelligence, and aerospace industries, to name a few. Ongoing equity market volatility continues to provide opportunities to add value by identifying mispriced stocks and tax-loss harvesting to improve after-tax returns. Following the global equity selloff, we are also finding attractive long-term opportunities by investing with select outside managers who have long track records of expertise in U.S. small-mid cap and non-U.S. equities.

Where are Opportunities in Fixed Income?

For the first time in decades it is possible to lock in a return of 4-6% in high-quality fixed income with minimal credit or interest rate risk. The chart to the right shows where yields are today compared to the end of 2021.

Bond market volatility has recently spiked to levels last seen during the 2008 financial crisis. Heightened bond volatility requires a dynamic and nimble approach to identify fixed income opportunities and manage risks. We are finding a lot of value in short-term treasuries as well as select municipal bonds, short duration corporate bonds, and private credit.

How are we positioning portfolios for clients?

We are capitalizing on the current investment landscape by transitioning client portfolios into our best ideas across asset classes in a tax-efficient manner. Below are a few examples of how we are adding value for clients:

Conclusion

Inflationary pressures forced a paradigm shift to more restrictive monetary policy that began in early 2022. The spike in yields and sell-off in stocks has created opportunities and we believe dynamically managed portfolios offer attractive returns over the next 5 years.

Disclosure

Clarendon is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Clarendon and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.clarendonprivate.com. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that wilt occur. The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not consider any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, no liability for, decisions based on such information and it should not be relied on as such. Although bonds generally present less short-term risk and volatility risk than stocks, bonds contain interest rate risks; the risk of issuer default; issuer credit risk; liquidity risk; and inflation risk. Risk associated with equity investing include stock values which may fluctuate in response to the activities of individual companies and general market and economic conditions. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. All investments include a risk of loss that clients should be prepared to bear. The principal risks of Clarendon strategies are disclosed in the publicly available Form ADV Part 2A.